Why I Built CshFlow

I built CshFlow because I was tired of feeling guilty about buying a coffee.

Not because I couldn't afford it—but because I didn't know if I could. You know that feeling? The constant mental math of "okay, rent is due in 12 days, and I think there's a hydro bill coming, and wait—did that subscription renew yet?" It's exhausting.

I tried so many budgeting apps. They all wanted me to categorize every purchase, set spending limits, stick to a plan. I'd start strong, fall behind after two weeks, then feel like garbage when the app showed me all these categories I'd "overspent" in.

Eventually I realized: I didn't need a budget. I just needed an answer to one question.

"How much can I actually spend today without screwing up my bills?"

That's all I wanted to know.

The problem with budgeting

Turns out I'm not the only one who feels this way.

“A survey found that 83% of Americans say they overspend, and 84% who have a monthly budget say they exceed it.”

84% of people who have a budget exceed it. That's basically everyone. Maybe the problem isn't us—maybe it's the approach.

Traditional budgeting asks you to predict the future. You're supposed to decide in advance how much you'll spend on groceries, entertainment, and "miscellaneous" (a category that somehow explodes no matter what number you put in there). It assumes you have time and energy to track every dollar. Who does?

Life doesn't work that way. Sometimes you need new tires. Sometimes you want to treat a friend to dinner. Sometimes you just want the fancy cheese without a mental cost-benefit analysis.

That doesn't make you bad with money. It makes you human.

Why budgets actually backfire

Here's the part that surprised me: budgeting doesn't just not work—it can make things worse.

“The cruel irony of restrictive budgeting is that it can lead to exactly the behavior it's trying to prevent.”

It's like crash dieting—the restriction itself creates the problem. Researchers found that budgeting causes "restrict-and-splurge" cycles. Overspend one week, restrict the next, then overspend again. People who track budgets aren't any more likely to hit their financial goals than people who don't.

And when we "fail" our budget? Shame. Which doesn't motivate change—it just makes us avoid thinking about money altogether.

What I actually wanted

I didn't need another app telling me I spent too much on takeout. I needed something that would look at my actual situation—my bank account, my bills, my payday—and tell me what was safe to spend.

Not what I should spend according to some budget I set three weeks ago when I was feeling optimistic. What I could spend today without screwing myself over later.

So I built it.

How CshFlow works

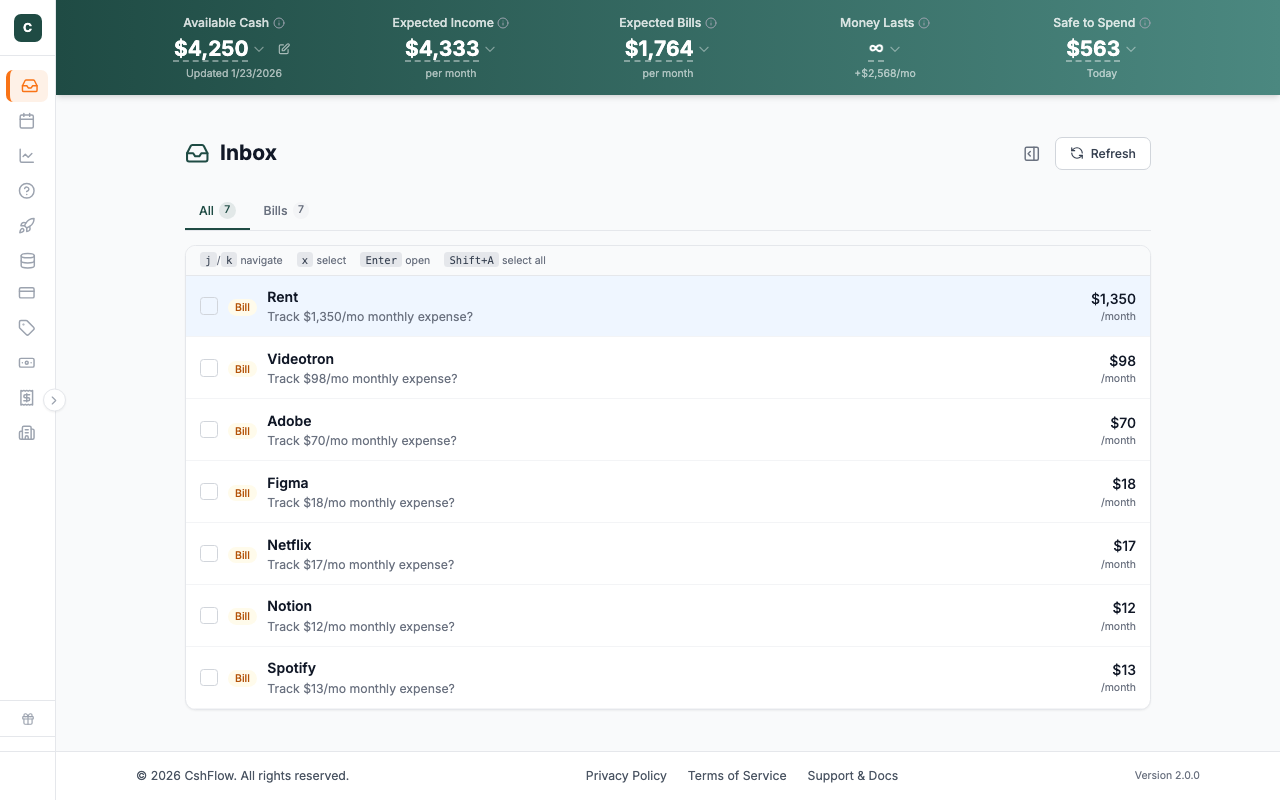

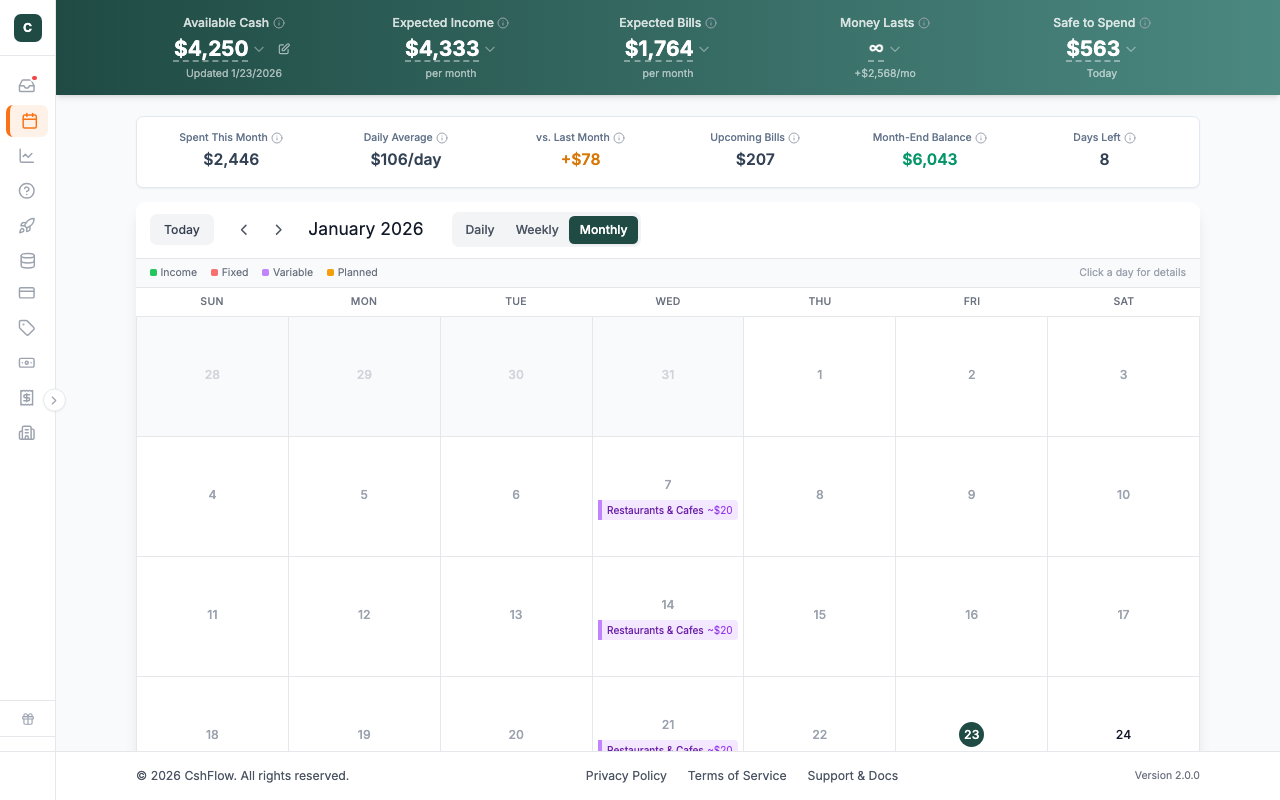

CshFlow doesn't ask you to budget. It looks at your bank transactions and figures out the patterns on its own—your rent on the 1st, Netflix every month, payday every two weeks.

Then it does the math you've been trying to do in your head—except it actually finishes the calculation instead of trailing off into vague anxiety.

Every day, it tells you: "Here's what's coming up. Here's what you have. Here's what you can spend."

It also rounds in your favor. If you have $142.73 after bills, it shows you $140. A little cushion, because money is stressful enough.

Who this is for

I built CshFlow for people who are doing fine—but don't always feel like it. People who have enough, but still get that knot in their stomach when they tap their card. People tired of feeling guilty about spending money on things that make them happy.

You don't need to be "fixed." You're not bad with money. You just need clarity.

That's what this is. No judgment, no lectures—just a straightforward answer: "What can I spend today?"

If this sounds like what you've been looking for, I'd love for you to try it. CshFlow is free to start, and you can be set up in minutes.

If you have questions or feedback—or just want to say hi—I'm around. This isn't a big faceless company. It's just me, building something I wish I'd had years ago.

💚

Want to dig deeper?

If you're curious about the research behind why traditional budgeting struggles, here are a couple of interesting reads:

- •Budgeting: What Our Research Uncovered — Irrational Labs' 10-week study on budgeters vs. non-budgeters

- •The Psychology of Money: Why We're Bad at Predicting Expenses — UVA Darden on why our brains aren't wired for budget tracking

Keep reading

Why Your Bank Balance Lies to You (And What to Trust Instead)

That number in your banking app isn't what you can actually spend. Here's how to see past the false confidence and know your real available money.

The Sunday Money Check-In: A 5-Minute Weekly Ritual

Forget hour-long budget reviews. This simple weekly check-in takes 5 minutes and keeps your finances clear without the stress.

Freelancer Cash Flow: Managing Money When Income Is Unpredictable

Fixed budgets don't work when income varies wildly. Here's a cash flow approach designed for freelancers, contractors, and anyone with irregular pay.

Ready to know what you can spend?

CshFlow shows you exactly how much you can spend each day. No budgeting required.

Get started free